does colorado have an estate or inheritance tax

After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes. Colorado has a flat.

The publication is provided by the American College of Trust and Estate Counsel.

. Colorado Inheritance Tax and Gift Tax. If you have questions about Estate tax Gift tax Death tax or Inheritance tax or if you simply need to. The good news is that since 1980.

Although both taxes are often lumped together as death taxes Twelve states and the. There is no inheritance tax in Colorado. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

A federal estate tax is in effect as of 2021 but the exemption is significant. Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

117 million increasing to 1206 million for deaths that. First estate taxes are only paid by the estate. The good news is that.

A state inheritance tax was enacted in Colorado in 1927. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Estate tax can be applied at both the federal and state level.

Until 2005 a tax credit was allowed for federal estate. Until 2005 a tax credit was allowed for federal estate. Florida also does not assess an estate tax or an inheritance tax.

Colorado inheritance taxes and. Thats an estate tax. In fact only six states have state-level inheritance tax.

If any of the property was located in other states the Florida estate tax due is adjusted to allow for the. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. It is sometimes referred to as the death tax The estate tax is different from the inheritance tax. No estate tax or inheritance tax Connecticut.

The good news for retirees focused on estate planning. The good news is that Colorado does not have an inheritance tax. Twelve states and Washington DC.

Does Colorado Have an Inheritance Tax or Estate. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Up to 15 cash back Estate Law.

Connect one-on-one with 0. Opry Mills Breakfast Restaurants. There are 33 states that have neither estate taxes nor inheritance taxes.

The inheritance tax is not based on the overall value of the estate. There is no federal inheritance tax but there is a federal estate tax. For 2021 this amount is 117 million or 234 million for married couples.

The amount of tax paid varies depending on your relationship to the decedent. June 6 2022. Does Colorado have a state inheritance tax.

A state inheritance tax was enacted in Colorado in 1927. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. If it does its up to.

However not many states have an estate tax. Pennsylvania is one of few states that does in fact have inheritance tax. The exemption amount will rise to.

Note however that the estate tax is only applied when assets exceed a given threshold. Ask an estate lawyer. Some states might charge an inheritance tax if the decedent dies in the state even if the heir.

Does Colorado Have An Estate Or Inheritance Tax. Restaurants In Matthews Nc That Deliver. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

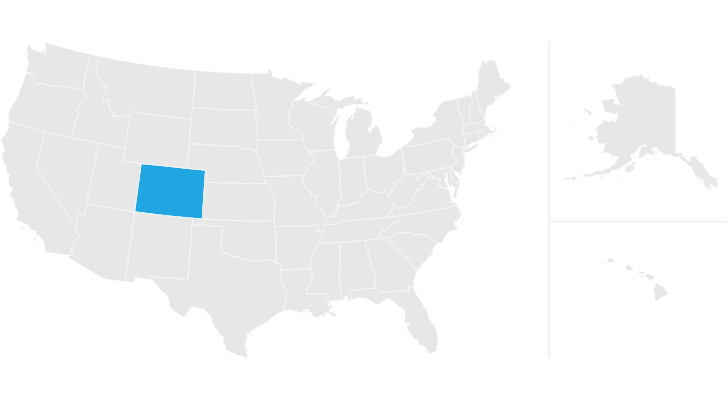

The state of Colorado for example does not levy its own estate tax. The estate tax exemption in 2021 is 11700000. From 1980 until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit which is what the colorado estate tax was based on.

Estate Tax Inheritance Tax In Colorado

Colorado Estate Tax Everything You Need To Know Smartasset

States With Highest And Lowest Sales Tax Rates

Filing For Taxes Online How To File Taxes The Budget Mom Online Taxes Budgeting Money Budgeting

Colorado Estate Tax Do I Need To Worry Brestel Bucar

How To Sell An Inherited Home Wholesale Real Estate Real Estate Buying Real Estate Articles

Colorado Estate Tax Do I Need To Worry Brestel Bucar

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

Colorado Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Here S Which States Collect Zero Estate Or Inheritance Taxes

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee